Our Rates

Our Rates

We offer competetive rates for all our services, with the actual fee varying according to the type and complexity of the specific task involved. Please call us to discuss your needs, we will be happy to provide you with a cost estimate.

Complexity of a tax return refers both to the number of forms involved as well as any complications related to the specific forms. For example, Schedule A Itemized Deductions can be a very simple form or a very complicated form. For this reason, we feel it would be unfair (sometimes to us, often to you) to charge a flat "per page" fee. Similarly, a "per hour" charge can be unfair to either party in different situations. To alleviate these problems, we track our time and then compare that to the actual complexity of the finished product to arrive at a fair price.

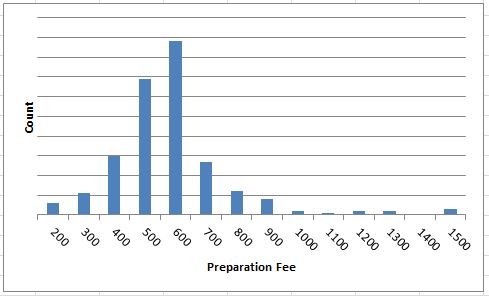

We have posted the histogram of our actual 2020 filing fees to help you get an idea of our typical fee range.

Although every tax return is unique, it is often possible to reduce the preparation fee by organizing and presenting your data to us in a format that allows us to focus right from the start on the actual tax issues involved. An extreme example is the proverbial "shoe box of receipts." It can take several hours to sort and organize these documents and then we can begin preparing the tax return. No matter how organized you are, please do not hesitate to ask us if your information can be presented in a manner that helps us even more. Lower tax preparation fee = Happy client = More referrals. We love a win-win!